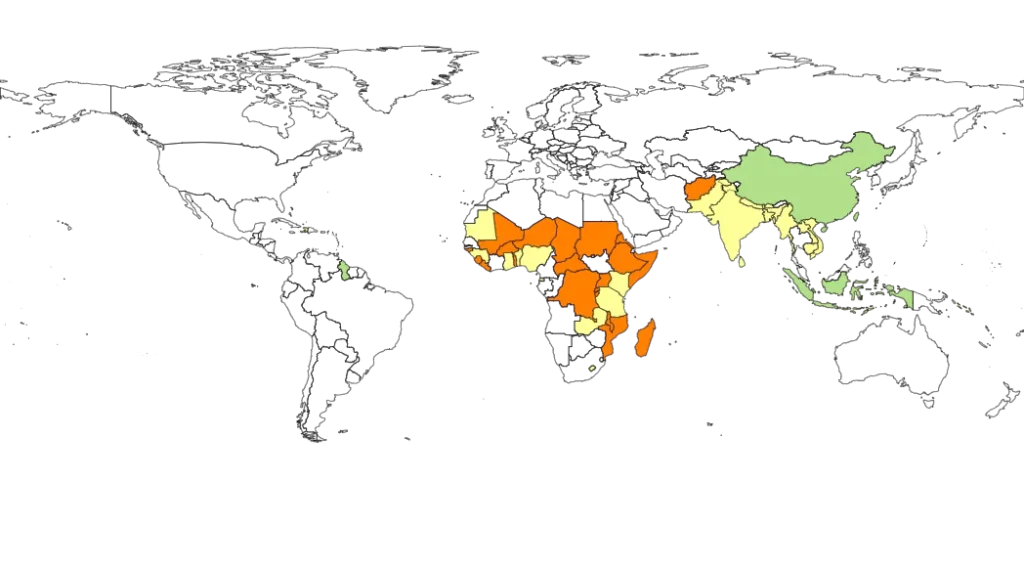

The debt burden of the world’s 26 poorest nations is now at its highest level in 18 years, according to a new report from the World Bank. These countries, which are home to 40% of the world’s most impoverished populations, are struggling under increasing debt and vulnerability to external shocks such as natural disasters, armed conflicts, and institutional fragility. The report highlights the dire state of these economies and the growing challenges they face as the global economy continues its recovery from the COVID-19 pandemic.

Table of Contents

Also Read: If World’s Top 5 Richest People donate $1Million per day, they’ll go bankrupt in 2183 years

Poverty Levels Worsen Post-Pandemic

While much of the world has bounced back from the economic impacts of the pandemic, these low-income countries have fallen further behind. On average, they are poorer today than they were before COVID-19. The report sheds light on a significant setback in global efforts to reduce extreme poverty and highlights the crucial role the World Bank’s International Development Association (IDA) plays in supporting these struggling economies.

Debt-to-GDP Ratio Reaches 18-Year Peak

One of the key findings from the report is that the average debt-to-GDP ratio for these 26 nations has surged to 72%, the highest since 2006. Market financing options have largely dried up, forcing these countries to rely heavily on grants and near-zero interest loans from institutions like the IDA. Alarmingly, half of these nations are either already in debt distress or at high risk of falling into it.

Conflicts and Fragility Deepen the Crisis

The report also points out that two-thirds of these countries are facing armed conflicts or institutional instability, making it difficult to attract foreign investment and maintain economic stability. Nations like Ethiopia, Chad, and Congo are listed among the most affected, along with non-African countries like Afghanistan and Yemen. These conflicts, combined with a reliance on exporting commodities, subject these economies to volatile boom-and-bust cycles that further hinder long-term growth.

IDA: A Lifeline for the Poorest Countries

In response to these challenges, the World Bank has increased its efforts to provide financial support to the most vulnerable economies. Over the past five years, the IDA has been a crucial source of funding for these nations, offering grants and loans to help them stay afloat during times of crisis. World Bank Chief Economist Indermit Gill emphasized the importance of this support, noting that, “At a time when much of the world has stepped away, IDA has been their lifeline.”

In 2021, the IDA raised a record $93 billion to support these economies, and World Bank President Ajay Banga is now aiming to exceed this amount, with hopes of securing more than $100 billion in pledges by December 6 of this year.

The Growing Impact of Natural Disasters

In addition to conflicts, these countries have been increasingly impacted by natural disasters, which have taken a heavier toll on their economies in the past decade. From 2011 to 2023, natural disasters have resulted in average annual losses of 2% of GDP for these nations—five times higher than the average losses experienced by lower-middle-income countries.

This vulnerability to climate-related events highlights the urgent need for increased investment in disaster resilience and sustainable infrastructure. The World Bank’s report underscores the importance of global financial support in helping these nations mitigate the devastating effects of such disasters.

Call for Greater Self-Reliance

While external support is critical, the report also calls on these countries to take more proactive steps to strengthen their own economies. The World Bank recommends improving tax collection methods by simplifying taxpayer registration and enhancing tax administration systems. Additionally, improving the efficiency of public spending could help these nations make better use of the resources available to them.

Despite the heavy reliance on international aid, the report suggests that by implementing better fiscal policies and improving governance, these countries could begin to chart a more sustainable economic course.

A Global Responsibility

As the world’s poorest nations continue to struggle, the role of global institutions like the World Bank and IDA becomes even more critical. With the upcoming World Bank and International Monetary Fund annual meetings in Washington, the international community will have the opportunity to renew its commitment to supporting these vulnerable economies.

Through a combination of increased financial support, better domestic policies, and a focus on resilience against conflicts and natural disasters, there is hope that these countries can begin to recover from their current economic challenges. However, without immediate action, the debt crisis facing the world’s poorest nations could have long-lasting impacts, further exacerbating poverty and instability.